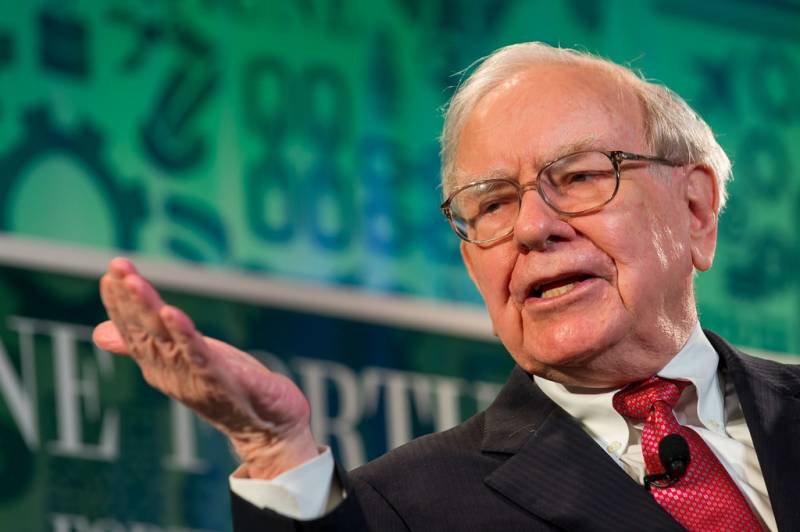

Warren Buffett is brought in to save the US banking system

One of the largest American investors, Warren Buffett, is negotiating with the White House to save the situation in the banking sector. This was reported by Bloomberg.

According to the publication, the businessman can take a number of steps that can bring the American banking system out of the crisis. Washington decided to involve Buffett and his company Berkshire Hathaway to buy stakes in regional banks suffering from the situation in the economy.

The fact is that on the eve of the increase in the key rate in the United States and the inclusion of the printing press, inflation may rise, and the authorities are interested in attracting some kind of financial reducer for large-scale and controlled injections into the banking sector.

At the same time, Warren Buffett is known for his investments in undervalued assets. The businessman is the largest shareholder of Bank of America, JPMorgan Chase, Wells Fargo, Goldman Sachs, US Bancorp and Bank of New York, and also owns controlling stakes in several other banks.

The entrepreneur himself justifies his decision to invest in regional banks with the opportunity to capitalize on a fallen market by buying back shares and distributing them among Berkshire Hathaway shareholders by converting them into shares of the parent company. At the same time, part of the liquidity received from the Fed will be used to pay dividends to shareholders.

As a result of such actions, the banking system will become more centralized, which in the future will facilitate the introduction of digital currency into circulation. Along with this, the global economic system linked to the dollar will remain.

Information