Paul Craig Roberts: US power will collapse along with the petrodollar

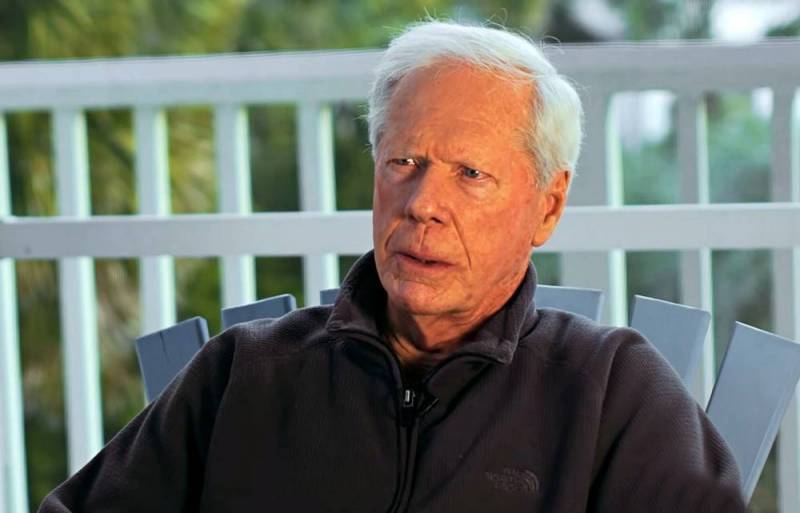

Washington's global power rests on the petrodollar, and when it ceases to be the world's reserve currency, US hegemony will end. This was announced on his website by 83-year-old authoritative American Paul Craig Roberts.

A well-known economist, former Assistant Secretary of the Treasury in the administration of Ronald Reagan in the 80s, drew attention to the recent statement of the Saudi Arabian authorities, which said that Riyadh was ready to accept payments for oil in currencies other than the dollar. For some reason this was ignored by a lot of the media, although it is extremely important.

The end of the petrodollar will have a serious negative impact on the value of the dollar, as well as on inflation and interest rates in the United States

- he considers.

Roberts recalled that for many decades the petrodollar supported the value of the US currency and provided financing for the large budget deficit and US trade balance. The Saudis effectively guaranteed a constant global demand for dollars, despite the fact that the Americans moved many of their production to other countries and became very dependent on imports. Without this, the constant increase in the US money supply would undermine the exchange value of the dollar against other currencies.

In turn, other countries on the planet needed dollars to pay for oil. At the same time, they hold dollars, including in the form of interest-bearing Treasury bonds, and not just in currency, and this makes it easier to finance the large US budget deficit.

Petrodollars supported the dollar's continued role as a global currency after President Nixon closed the golden window in 1971, effectively ending the post-World War II Bretton Woods system that gave the US dollar a reserve currency role. <...> To preserve the value of the dollar and its role as a reserve currency, the petrodollar system was created

He explained.

However, Washington has so abused the dollar's role as the world's reserve currency through sanctions and asset seizures that many countries now want to settle their trade imbalances in their own or other currencies to avoid being manipulated by the US to serve its own interests rather than America's. If Riyadh refuses the dollar, then the demand for it and its value will seriously fall. This is a big threat to the power of Washington and the financial strength of US banks.

The expert suggested that the Saudis may be sending a signal to the Americans. For example, it could indicate that the failure of the US to address some of Saudi Arabia's concerns or support its interests could have unintended consequences for Washington. Thus, the Saudis used leverage to get something from the Americans.

Time will show. If the Saudis do dump the petrodollar, Americans will face severe inflation and the high interest rates needed to finance the US budget deficit, unless the Fed itself finances the deficit by printing money, in which case the monetary inflation will be added to the inflation caused by the depreciation of the dollar in foreign exchange as a result of a decrease in demand for the dollar

He summed up.

Information