Russia's limited transport infrastructure creates risks for trade with China

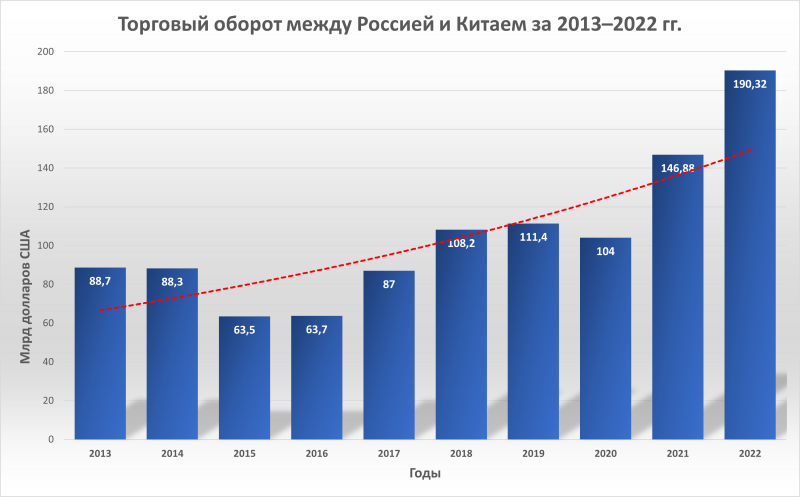

According to the General Administration of Customs of the People's Republic of China (GAC) on January 13, 2023, the trade turnover between China and the Russian Federation in 2022 amounted to $190,271 billion, which is 29,3% more than in 2021, all leading news agencies have already reported this. our country. Such indicators are record-breaking in history, the previous historical maximum was recorded at the end of last year - $ 146,88 billion with an annual growth of 35,8%. Of course, now we are dealing with data from the Chinese customs service, and not the Russian Federal Customs Service, so financial information can be adjusted.

Recall that on June 4, 2021, at the St. Petersburg International Economic Forum (SPIEF), Vladimir Putin announced the goal: $200 billion in trade by 2024. Today, we can conclude that it has almost been reached, and with China gradually lifting anti-COVID restrictions, absolute numbers in 2023 are likely to be higher, although trade growth in percentage terms may decline. According to some estimates, it will be from 10% to 15%.

However, it is important and symbolic that Russia for the first time entered the top 10 largest trading partners of China, which account for half of China's total foreign trade ($6,31 trillion). And although we took the last, 10th place (3% of China's total trade turnover with all countries), overtaking Brazil ($171,5 billion), there is reason to believe that Russia will gradually rise in this top ten. The United States (759,4 billion dollars), South Korea (362,3) and Japan (357,4) traditionally remained the leaders, the volume of trade with Taiwan (-2,5%), Hong Kong (-15,1%) decreased, Germany (-3,1%) and Australia (-3,9%). The growth of China's trade turnover with the United States and South Korea practically stopped in 2022 - +0,6% and +0,1%, respectively. In addition to Russia, China's growing foreign trade partners are Singapore (+23%), Canada (+17%), Malaysia (+15,3%), Brazil (+4,9%) and Vietnam (+2,1%). ).

The bar chart below shows the data of the Federal Customs Service of the Russian Federation on trade with China, as well as the Main Customs Administration of the PRC (for the last year), showing the dynamics of Russian-Chinese trade relations in the last decade.

How to “read” trade data and why sanctions can affect its dynamics in different ways

Trade turnover, or trade turnover between countries, consists of the value of exports and imports, that is, the sum of all goods sold abroad and all products imported into the territory of our state, in monetary terms. Trade turnover is usually calculated in billions of US dollars. The growth rate from year to year means that economic cooperation and trade relations between countries are strengthened, and vice versa. This can be seen in the chart above. And if you know the key events in the global economy and policy, you can link them to turnover data to identify and explain some of the cause-and-effect relationships.

For example, in 2020 there was a stagnation of trade relations between Russia and China. But we know that on January 30, 2020, WHO declared an emergency, and on March 11, 2020, a COVID-19 pandemic, which led to the "closure" of most of the world's economies and disruption of supply logistics. This is a perfectly reasonable explanation for the fact that the growth of trade between China and Russia has stopped in 2020.

Now let's look a little further into history. The histogram above shows that 2015 and 2016 were not the best years for Russian-Chinese trade relations, the drop in trade is obvious. What could lead to this? There are probably two main factors:

1. Sanctions of the collective West against Russia. During the presidency of Barack Obama, and more precisely in 2015-2016, only the United States was put into effect 555 sanctions packages. Officially, China did not join them and even condemned them, but in fact many Chinese companies, which had trade with the US and the EU as a priority, were not eager to fall under the hot hand of the West. In addition, in 2015, Chinese enterprises with state participation were advised not to cooperate with Crimean companies; credit organizations in China (except for ExIm Bank and China Development Bank) began to evade issuing loans, some entrepreneurs were forced to close accounts and transfer funds to other places; the AliExpress Internet marketplace, which is part of the Alibaba Group, stopped serving the residents of Crimea; even supplies of agricultural products from China have decreased. Of course, all this was against the background of friendly, but not so developed, Russian-Chinese economic relations that took place almost a decade ago.

2. Crisis phenomena in the world economy, the fall in Russia's GDP and energy prices. The sanctions affected the reduction of the gross domestic product in our country (-0,5%), but the main part of this negative phenomenon (-4%) was caused by a more than twofold drop in oil prices at the end of 2014: from $103 to $50 per barrel. The weighted average dollar exchange rate has more than doubled: from 31,8 in 2013 to 67 rubles in 2016. The general slowdown in the Russian economy could not but affect the reduction in trade with China in monetary terms. However, in terms of physical volume, the quantity of goods from the PRC to the Russian Federation and from the Russian Federation to the PRC changed not so significantly: the drop occurred primarily in value due to a decrease in world market prices for commodities and oil.

A fair question arises: why did sanctions and crisis phenomena in the global economy after the reunification of Crimea with Russia have affected the decline in trade with China, while sanctions after the start of the NWO in Ukraine did not?

There are three things here that weren't there before:

First, the At that time, China still saw its future in inseparable trade and economic relations with the United States and tried, if not to support sanctions against Russia, then clearly not to contradict them. But everything has changed. And not after the start of the anti-Chinese policy of Republican Donald Trump, but after Democrat Joe Biden became its successor, aggravating the situation around Taiwan. It became clear to the Chinese that confrontation and sanctions against the PRC could no longer be avoided by them. For example, now more than half of US states have banned civil servants from using Chinese TikTok, and with the tightening of US export controls, microchip imports to China have decreased by 15%. In parallel with this, the reaction of the PRC is obvious. According to Bloomberg, Chinese (and Russian too) businessmen are absent from the World Economic Forum, and China may send Deputy Prime Minister Liu He, who is resigning in March 2023, to Davos, which is symbolic and may mean that the West is no longer interested in China . In addition, China unofficially launched a visa war with Japan, South Korea and the United States. Nevertheless, a number of Chinese companies tied to trade and exchange technology with the US and the EU, are still afraid to openly trade with us.

Second, the The economy and financial system of Russia has accumulated a margin of safety, which was not in excess as of 2014, and Russian-Chinese relations have reached a new level. As a result of pseudo-import substitution, the production of most of the products is localized on the territory of our country, but using the Chinese component base. New logistical routes for energy supplies have been put into operation, long-term contracts have been concluded, and new gas pipelines to the Celestial Empire are being built. Thus, in 2022, natural gas supplies to China via the Power of Siberia gas pipeline increased by 49%, amounting to 15,5 billion cubic meters. m against 10,39 billion cubic meters. m in 2021. And according to Reuters, at least four Chinese supertankers are transporting Urals oil from Russia to China after the introduction by the EU and G7 countries of the price ceiling for Russian oil supplied by sea.

Third, world prices for food, fertilizers and energy remained at a high level throughout 2022, and these goods are an important part of Russian exports. As a result, by selling less to Europe and the US and applying discounts to commodities, exports continued to rise in value terms. Especially considering that China has increased the volume of purchases of these goods in the Russian Federation. This situation is connected precisely with the introduction of large-scale anti-Russian sanctions, the refusal of Europeans from Russian raw materials and, as a result, with the violation of supply chains.

So trade turnover data is not faceless numbers, but valuable information that helps to conduct both economic and political analysis.

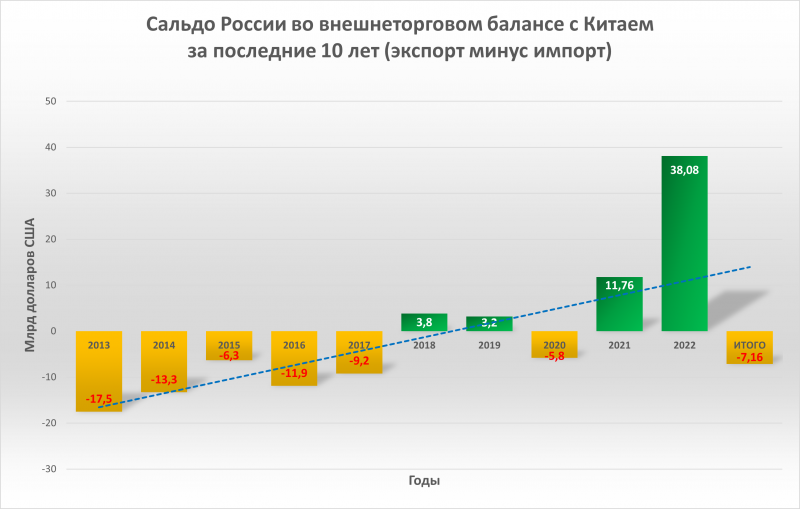

The positive balance of Russia and the structure of trade

The structure and dynamics of trade turnover in terms of exports and imports between Russia and China, covering the last decade, is presented in the histogram above. The head of the Federal Customs Service of Russia, Vladimir Bulavin, previously reported that the structure of imports from China to the Russian Federation has changed: in 2022, there was an increase in deliveries from the Celestial Empire of automotive, special construction and road equipment, as well as compressors and production lines. More than two-thirds of all Russian exports are energy resources (gas - pipeline and LNG, oil, coal, fuel oil), followed by mineral resources, timber, and agricultural products. After the easing of covid restrictions, supplies from Russia to China of fish and fish products resumed and increased, exceeding 1 million tons in physical volume and $3 billion in value. However, it should be taken into account that there are also closed items of trade turnover, apparently devoted to military technologies and products, information on them is not disclosed.

It is not possible to study in detail the composition of imports and exports within the framework of this article, so we will confine ourselves to considering trends. And the main one is the formation of a positive trade balance with China, which has been manifesting itself over the past 5 years. Before that, we traded with a chronic negative balance. And only the last 2 years allow us to assume that today we are dealing with a trend, and not with a combination of circumstances. However, even the impressive trade surplus of the past two years has not offset the accumulation of a negative balance over the period from 2013 to 2022. In total, we have not reached the net balance yet (see the histogram below). Today, China accounts for up to 40% of all Russian imports, although in previous years this figure did not exceed 25%.

What does the concept of "positive balance" mean? In monetary terms, we sell more to China than it sells to us, given the value of all the goods we trade with each other. The trade balance is active. Is it good or bad, important or not?

In the Economic Security Strategy of the Russian Federation for the period up to 2030, approved by Decree of the President of the Russian Federation No. 13.05.2017 dated May 208, 21.01.2020, the trade balance is included among the indicators of the state of economic security. In the Doctrine of Food Security of the Russian Federation, approved by Decree of the President of the Russian Federation dated January 20, XNUMX No. XNUMX, among the main tasks of ensuring it, regardless of changes in external and internal conditions, is to achieve a positive trade balance in agricultural products, raw materials and food.

The listed documents in themselves testify to the extreme importance of an active trade balance, since a positive trade balance largely characterizes Russia's favorable and stable economic position in the international market, which weakens its dependence on the state of the world market and competition, and on the political decisions of other states.

Risks to China's foreign trade are our risks too

China's total trade turnover in 2022 continued to grow (+4,4%), despite the cooling of external markets and the problems of the pandemic, but the data for December 2022 can be called an alarming bell. Usually this month in the Middle Kingdom shows growth, which is traditionally associated with the completion of large projects by the Chinese New Year (from January 21 to 22, 2023), but not in this case. Compared to the same period last year, not only imports (-7,5%), but also exports (-9,9%) showed a pronounced decrease. If we take into account that the previous Chinese New Year fell on February 1, 2022, and take into account the data not for December, but for January, then in this case the picture looks depressing.

Despite undeniable gains in 2022, such as a 54,4% increase in car exports to 3,11 million units, making China the second auto exporter after Japan to leave Germany behind, there are subtle but important signals that that not all is well in the Kingdom of Denmark.

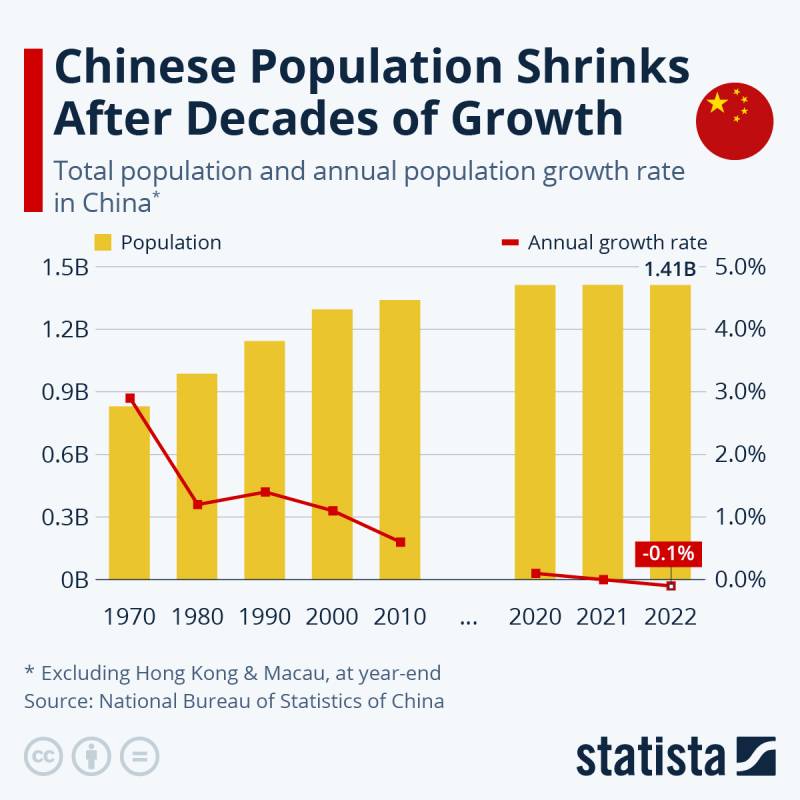

For example, according to the State Statistics Service of the People's Republic of China on January 17, 2023, for the first time since 1961, the population of the country decreased by almost a million, and in the period from 2010 to 2020, the decline in the working-age population (16-59 years old) amounted to 40 million people, or approximately 4,5% of the current working-age Chinese (875,6 million people). The first figure can still be explained by the outbreak of COVID-19: according to the Chinese Commissariat of Health, 2022 thousand people died from covid in December 60, but the second is a trend that has formed (see the bar chart below).

China's GDP for 2022 showed an increase of only 3% (according to preliminary calculations), which is even lower than its own forecasts (5,5%). This indicator of gross domestic product should be considered China's second anti-record in half a century after the covid 2020 (2,3%).

You can guess what all this is connected with:

– with the latest outbreak of COVID-19 in China;

- with the growing confrontation between China and the collective West;

with the onset of a global economic recession.

“What do we care about economic problems in China when there are enough of our own?” - you ask. But the fact is that they will directly affect the mutual trade and, as a result, the stability of the Russian economy.

Even if the risks listed above for China are not systemic, there is still a risk that the growth of trade between our countries will slow down in 2023. And first of all, due to the achievement of the maximum throughput of the Russian transport infrastructure, and also due to the fact that domestic exports will complete their reorientation from the European Union to the Asia-Pacific region, having exhausted their potential.

In such a situation, the growth driver of trade turnover between Russia and China should be:

– an increase in the share of goods with high added value in Russian exports (relatively speaking, gasoline, not oil);

– joint infrastructure projects in Russia and the deepening of trade cooperation in general.

Whether we will be able to launch the said growth driver is a big question. However, there are hints of a solution to the problem. On December 5, 2022, Russian Prime Minister Mikhail Mishustin, after a meeting of the heads of government of Russia and China, held in the format of a videoconference, said:

The portfolio of the intergovernmental Russian-Chinese commission includes 79 significant and promising projects totaling more than $160 billion. Among them are joint projects in the field of mining, industrial production, agriculture and construction of infrastructure facilities.

Information